Government of Canada | Seniors Forum

Updated August 27th, 2024

Many Canadians are concerned about how to manage their money, property, and finances as they age or as life changes take place. They may worry about what will happen if they become unable to deal with their own finances. It is a good idea to plan ahead for a time when you may need help managing your affairs.

Two tools often used for managing financial affairs are powers of attorney and joint bank accounts. It is important to know how a power of attorney or a joint bank account works before you use them. There are risks and advantages to both. You should never feel pressured to sign a power of attorney or to open a joint bank account.

Carefully consider all of your options before making any decisions.

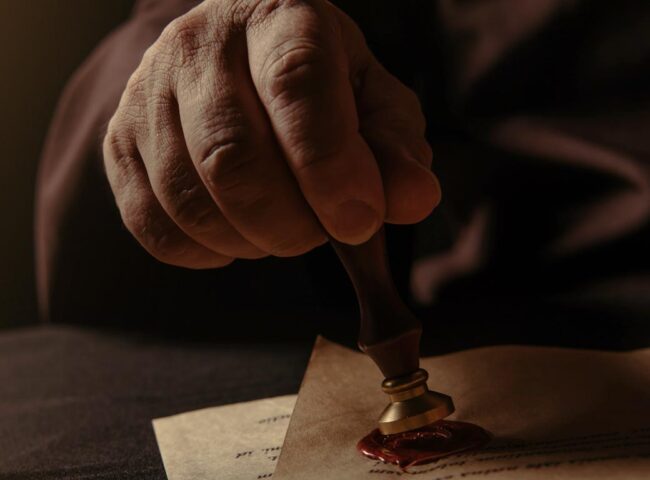

A power of attorney is a legal document that you sign to give one person, or more than one person, the authority to manage your money and property on your behalf. In most of Canada, the person you appoint is called an “attorney.” That person does not need to be a lawyer. Among other requirements, you must be mentally capable at the time you sign any type of power of attorney for it to be valid. In general, to be mentally capable means that you are able to understand and appreciate financial and legal decisions and understand the consequences of making these decisions. However, the legal definition of mental capacity will vary based on the laws in each province or territory.