Published on Good Trust

May 14th, 2024

Cryptocurrency in estate planning has become increasingly important as digital assets gain popularity and value.

The term itself can be difficult to understand. Therefore, learning how cryptocurrencies work will help you make informed decisions when planning for their inclusion in your estate plan.

Cryptocurrency assets, such as Bitcoin and Ethereum, are stored in digital wallets, which are accessed using private keys or passphrases. For estate planning purposes, it’s essential to securely document and store these access credentials to ensure your digital wealth is managed according to your wishes.

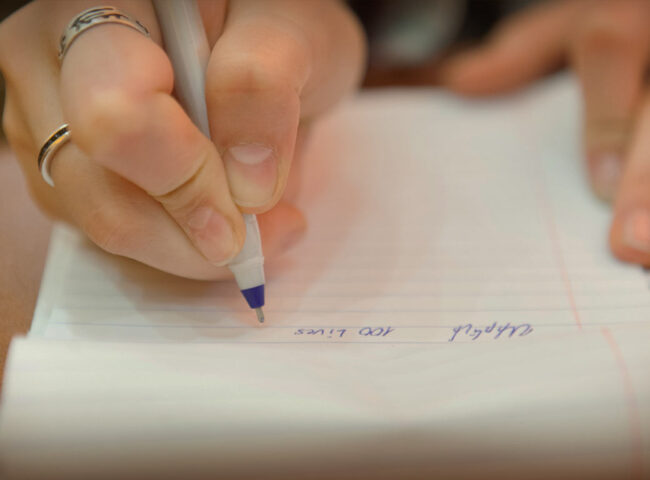

To include your cryptocurrency in your estate plan, start by creating a comprehensive inventory of your cryptocurrency holdings.

Remember, estate planning involving cryptocurrencies requires careful consideration and proactive measures. By following these steps and seeking professional advice as needed, you can ensure that your digital assets are appropriately managed and distributed according to your wishes.